|

A word of caution, though: If tempted on perusing these tomes to rush out and plunk down lots of hard-earned cash on some of the techniques described here, hold up! First, take a long walk, call a friend, count to a million, pinch yourself a few dozen times, or ask someone you trust to hide your checkbook and credit cards from you for a few weeks till you regain your senses.

Yes, one can make money at methods discussed in one or another of these books, yet a person can also lose money faster than at Monte Carlo. So, it is well to keep one's bets and risks small at first, till really knowing how the game is played. Hopefully one won't need to learn the way my dad and I did 26 years ago.

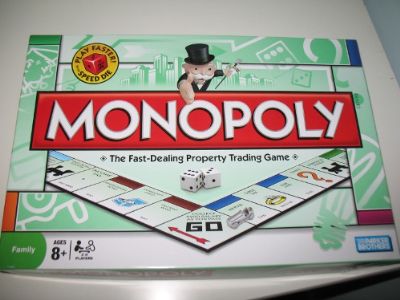

Another fun manner of play in the investing world is with fake money. One of most popular means is the old game of Monopoly, great amusement when I was growing up, still a favorite today.

| |