| Volume 19, Issue 8 | August 21, 2017 |

|

In this Issue:

|

| Volume 19, Issue 8 | August 21, 2017 |

|

In this Issue:

|

One imagines an experienced war veteran so good at his trade, so reliably, quickly, and efficiently dispatching the enemy, before it knows what hit him, that our hero earns the nickname, "General Anesthesia."

When I was seven years old, about 1951, I had my tonsils and adenoids removed and was put under using a cotton mask that covered my nose and mouth, through which liquid ether was dripped. It was not a particularly accurate method for attaining a patient's oblivion. Indeed, there are anecdotes about anesthesiologists and other medical staff of the time also being affected by the fumes, with consequences we can but imagine. At any rate, in my case all apparently went well.

In connection with a procedure to remove a large kidney stone that had gotten stuck blocking a tube needed for other things, last month I had my first general anesthesia since then. Although in ordinary awareness I was OK with this, my dreams in the nights leading up to the fateful date revealed misgivings. In a series of them, I evidenced panic, a beach strewn with mangled body parts, or faces missing key features. A sense of control is not readily given up. Who knows what might happen while we are unconscious?

A brother of mine was for awhile in intensive care, to outward appearances sedated and unconscious, yet afterward he related communicating with other patients in the same area, for instance trying through his out of body self to calm one of them who was especially anxious. Others have told of having had awareness of people around them while clinically they were in unresponsive states. Patients revived after so-called near death experiences have told of levels and kinds of awareness that might seem surprising to friends and relatives who were just observing their apparently comatose status.

In the event, last month things were rather different than in the early 1950s. The medical staff were all friendly, easily gained my trust, and seemed competent. The anesthetizing chemicals were applied via plastic tubes and a small gas mask. Machines helped the professionals monitor the amounts required, what was being administered, and my vital signs. I was told what to expect, and all went according to plan (so far as I know). Beforehand I was asked if I had questions. I mentioned knowing there is a little greater chance of harm from the anesthesia in older people, and the anesthesiologist gave me the option to have a tranquilizing substance that could allay anxiety about my procedure but which also involved a longer time required to recover vs. having only the amount of anesthesia called for to put me under and keep me there till the procedure were completed. I opted for the second, figuring I could deal with short-term nerves better than any long-term deficits from a longer time and depth of being "out."

That lithotripsy surgery failed. My kind of kidney stone is apparently too hard for the multiple ultrasonic blasts (over 3000 in about 45 minutes) to affect it. This means there is also no point attempting the same thing on an even larger stone stuck in another tube. In fact, there are a total of five large stones it would be better to remove if practicable. Late this month, a more complicated, longer procedure is to be done. If that one does not get the job done, a third would be required. Thus there will be more opportunities for good and necessary medical care, but also for things that might go wrong.

I drive almost every day, of course. The risks of this activity in the frequency involved are probably far greater, yet I hardly think about them as I commute here and there. Even walking in Austin can be more hazardous than having general anesthesia. There are numerous stories of pedestrians hit here by distracted drivers. I have had three falls while merely out with the dog in my own neighborhood, where decades' old sidewalk levels are irregular thanks to tree roots, settling during droughts or floods, and so on.

The chances of damage from general anesthesia are not readily obtained. I am sure insurance companies have this kind of actuarial information. Depending on Google, though, all I can quickly determine is that only about one in 200,000 general anesthesia procedures result in death attributable to the anesthesia itself, but that complications from anesthesia occur about 5% of the time. These secondary medical problems can include extremely mild to severe forms of dementia. Though it is difficult separating mishaps due to the anesthesia from those related to the procedures themselves, such potential difficulties do go up as we age.

General anesthesia (the term from ancient Greek, meaning loss of sensation) affects the whole body and usually induces a loss of consciousness.

Each night I fall asleep and then feel dead to the outer world. Oddly enough, though vulnerable in that state as well, I rarely consider the possibility I shall not awaken in the morning just as I always have before. I read news accounts or hear them on the radio about this or that person having "died in his (or her) sleep" and wonder what that really means. Did someone interview the people just shy of expiration and so determine that they were still slumbering? It seems a phrase intended to reassure the living, not to accurately depict what occurred for the deceased. I hope when I die it is significant enough that I do not sleep through the experience. In fact, maybe that is why general anesthesia is a little scary: a person could simply check out, cease to be, and never know it.

Anesthesia has been around for thousands of years. Though most ancient anesthesia was primitive, derivatives from the opium poppy had been used in one or two early civilizations since 4000 to 5000 years ago. Even as recently as the early 19th Century, though, anesthesia could be awfully crude by modern hospital standards. Laudanum, a blend of opium, alcohol, and other ingredients, was often used to simply dull the pain rather than providing general loss of consciousness. Hypnosis was tried but useless for most patients. Large quantities of whiskey also had their benefits. Usually, though, even as innovations were being tried that later would lead to general anesthesia via nitrous oxide (laughing gas), ether, chloroform, and morphine, for the vast majority of patients surgery was contemplated with terror, for there was no effective means to remove the severe pain during and after operations. In wartime, hundreds of thousands endured the removal of bullets, shrapnel, limbs, and portions of their faces with little or no anesthetic. Often as not, they were held or strapped down and told to just bite on a strap, piece of wood, or a bullet while enduring the agonies of surgery, typically passing out from the extreme discomfort and shock. Under such conditions, surgery-related deaths were naturally higher, even apart from the poor sterilization methods of the time.

Why do anesthetics work? This is as yet a matter for research. Evidently they inhibit the transmission of signals between nerve cells, but even today more needs to be learned about how.

In any case, I am glad that general anesthesia is available when invasive procedures are required. It seems much preferable to the proverbial biting of the bullet.

Caves are cool. Literally and figuratively. But what is more disappointing than to enter an enticing gap in the ground only to find that it simply dead-ends at that point, without leading on to deeper mysteries?

The most famous cave systems in the world are, of course, the largest, deepest, longest, and those with the most amazing mineral formations. The U.S. boasts some great ones: Carlsbad, Lechuguilla and Mammoth, as well as loads of others not as celebrated. Many residents of central Texas do not even know that the numerous caves of the Balcones Escarpment are home to one of the most biologically diverse biomes of troglobites and other cave dwellers in the world, comparable to Postojna Cave in Slovenia.

Average people rarely get to explore caves on their own. They are invited into carefully sanitized examples with ease-of-access accommodations in place, including adequate lighting, safety railings and strict supervision that keeps them on the path. A small number of adventurous spelunkers are willing to risk life and limb as they squirm through tiny passages, crawl into frighteningly narrow spaces and test the limits of their expertise in the name of exploration. For most of us, though, our underground ventures rarely extend past the edge of the light at the entrance. And that's not necessarily a bad thing. It's a lot of fun to check out a small karst feature without danger or the need for professional guidance.

There is just such a small cavern on the property of the Lady Bird Johnson Wildflower Center in Austin, Texas. In fact, there are two caves on the property, but one is slightly deeper and, of course, has the usual heavy bars and padlocked gate at the entrance that put quite a damper on an amateur explorer's sense of adventure. The other is so small and shallow that it is allowed to remain natural, with just a surrounding barrier of extremely thorny vines and shrubs and a small wooden gate.

There is just such a small cavern on the property of the Lady Bird Johnson Wildflower Center in Austin, Texas. In fact, there are two caves on the property, but one is slightly deeper and, of course, has the usual heavy bars and padlocked gate at the entrance that put quite a damper on an amateur explorer's sense of adventure. The other is so small and shallow that it is allowed to remain natural, with just a surrounding barrier of extremely thorny vines and shrubs and a small wooden gate.

I've learned a bit about the history of this particular little hole in the ground. When the Wildflower Center acquired the property, back in 1995, the opening was filled with debris; it had served the previous farm owners as a convenient garbage dump. Not only did the blockage ruin a perfectly good habitat, but it also kept water from seeping down to the Edwards Aquifer. A team of volunteers removed the rubble, no small task. It was hard and dirty work, but they cleared out an attractive little space, and the cleaning continues off and on as mud and rocks are cleared at the far edges.

For our ongoing documentation of the fauna in the gardens, I've taken a look into the cave several times. There is a large boulder so it is possible to step down into the shallow depression and then, if one bends down, take a few awkward scooting steps under the overhanging ceiling. As with everywhere else on the Wildflower Center property, I am always on the lookout for rattlesnakes, especially in areas that might be favorite hangouts. So far, I've not heard of any found in this cave, but I still look around carefully every time just in case.

The first animals I encountered were camel crickets. LOTS of them. I learned that I should always keep a hat on while in there or risk having them in my hair. During the hottest and driest times, nothing much is usually evident in such a bare and rocky location. I suspect that most animals retreat into deeper cracks where there is more moisture. When it is cooler and wetter, though, the cave is more welcoming to amphibians. I saw one of the largest toads I can remember calmly watching me from its perch near the wall during one visit. From its well-fed look, I suppose it had been feasting on camel crickets.

One animal that I had been hoping to see ever since I moved to this area over 30 years ago is a salamander. Of course I'll never see the famous blind cave salamanders in the wild, but I have known for a long time of the slimy salamanders that can sometimes be found under rocks or logs or, most notably, in shallow caves. I half-heartedly scanned the recesses in the little cave with my flashlight numerous times, wishing that I'd see a salamander but not particularly expecting to. Then someone told me that he HAD seen salamanders in that location. He said there were several, and they were climbing on the walls. This information came to me in early spring, so the weather was right for such a sighting and I lost no time in checking it out myself with renewed enthusiasm. My first try yielded a glimpse of a slimy tail as it quickly retreated into a little crevasse. Yes! I was sure that if I were more stealthy, I could see one without scaring it away.

|

|

The next week, the weather had still been very wet and cool. In spite of the muddy nature of the cave, not to mention the discomfort of having to bend down so much, I made another excursion into the darkness. I was keen to get photos of one of those elusive salamanders. This time I hit the jackpot and saw several of the fascinating amphibians. Not only did I see them, but a couple just sat and looked at me, allowing me to take pictures and view them up close. They were bigger than I expected, but looked just like pictures I'd seen. Out of curiosity about their "slimy" nature, I picked one up. It energetically wiggled right out of my hand! The slime was not just slippery, it was sticky too, sort of like slug mucus. I scraped off the mess, but also washed it off as soon as possible. The coating was remarkably persistent. I probably should have read up on these animals before experimenting with touching them, as I belatedly found out that the dried secretions are nearly impossible to remove from one's hands. Well, now I know.

Most recently, when I looked into the cave, expecting to perform the usual unproductive search for snakes before climbing down, I was startled to see one basking right on the large, flat, centrally located boulder that served as a step. It wasn't a rattlesnake but a checkered garter snake, and a beautifully marked one at that. I thought that at any moment it would dash off its perch and hide, so I carefully bent closer and closer as I took photos. The snake didn't move a whit. Then I noticed, on a lower rock, a small ground skink. What a reptile haven! As I was moving around the cave rim to get a different angle for pictures, the skink carefully slithered away under some fallen leaves. But the garter snake just watched me.  It had probably seen loads of people come and go and had learned that they weren't nearly as dangerous as birds or raccoons. I didn't have the heart to ask it to move so I could step down to check out the rest of the space, hence it had one more affirmation of its security inside that little refuge.

It had probably seen loads of people come and go and had learned that they weren't nearly as dangerous as birds or raccoons. I didn't have the heart to ask it to move so I could step down to check out the rest of the space, hence it had one more affirmation of its security inside that little refuge.

With all the small caves and other karst features in our area that are off limits due to their location or dangerous nature, it's nice to know there is one that I can easily look into and even explore. The dirt floor, craggy walls and rough ceiling are not particularly picturesque, but the chance of meeting the inhabitants of this little retreat lends an air of anticipation to my brief forays at the edge of the subterranean world.

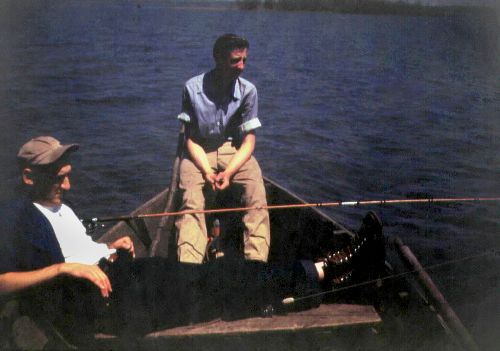

The iconic lazy summer pastime of fishing from a boat shown above features Val's father, John, and his soon-to-be-brother-in-law, Charlie (Evelyn's brother), in 1953. They were in a large rented motor boat along with Evelyn (who took the photo), her father, Chuck, and her other brother, Rich, on Spring Lake, a backwater of the Mississippi River, directly west of Chicago. It was a long drive from Joliet, but Ev says that her dad liked to drive fast. One funny incident during the day involved John losing his grip on the pole as he was casting and then having to retrieve it from the shallow, muddy water - a rather embarrassing escapade in front of future in-laws.

![]()

| (The Terra Tabloid is a venue for the discussion of issues pertaining to the past, present, and future of our planet and human interaction with it.) |

While the U.S. and many other nations are greatly restricting the number of refugees they will accept, the Faroe Islands are going out of their way to encourage immigration, including among refugees, though for approval to immigrate they must go through Denmark, as the islands, even if an autonomous country, are within the Danish Kingdom.

The Faroe Islands archipelago lies about halfway between Scotland and Iceland. Just this year it has achieved a long held goal of raising its population above 50,000. Its economy previously relied heavily on only two industries, sheepherding and fishing or whaling, and at times this has meant a volatile labor market. Lately the unemployment rate is extremely low, though, a bit less than 2%. To look at photos or videos of this tiny state one might not guess it, for the place is rugged, wet, windy, and cold, but the Faroe Islanders are rated as among the happiest people on Earth.

The Faroe Islands have an area of 541 square miles. The largest towns are Torshavn (pop. about 13,000) and Klaksvik (pop. about 5000). Despite its northern latitude, temperatures average above freezing year round, thanks to the Gulf Stream. Education is considered good, mostly free, and funded by the government. In the Faroe Islands higher education is available through the undergrad level. Students who wish graduate degrees need to go abroad, mainly to Denmark. Faroe Islanders' health care is also considered good and is mostly free.

Klaksvik, Faroe Islands - By Vincent van Zeijst - Own work, CC BY-SA (Wikipedia) |

Most of the new female arrivals, hundreds in fact, have come from Thailand and the Philippines. Both countries have quite different climates and cultures from the Faroe Islands, so it is a major adjustment for the newcomers. The local language is also not easy to learn. Nonetheless, even if the transition has been challenging for them, most are managing well. One immigrant woman of a few years ago, married now to a Faroe Islander, and they with their son living adjacent a beautiful fiord where the boy can daily play at the beach, when asked if she would not prefer to move into the nearby town where she can associate with more women from her home country, said no, that her rural circumstances are good, she loves her husband and son, and they live in a gorgeous setting, all the surrounding landscape to treat as their own.

What is the future like for the Faroe Islands? In some ways things may remain much the same, yet change is also coming. An as yet small but rising immigrant culture is enlivening the towns. Shops and restaurants cater to the newcomers and, in turn, offer more diversity of attire, cuisine, and entertainment for the more dominant, if stodgy portion of society. Some added liberalism is creeping in as well. Same sex marriages were recently accepted. And here too, as on the European continent, the aquaculture, digital, and energy revolutions have been mixing things up, allowing new economic niches to arise. Today, maritime vessels stop at Faroe Island ports enabling thriving commerce. Renewable energy, especially from wind, helps the Faroe Islands get over half their power from renewable sources. On a per capita basis, the abundant fish farming, financial services, IT, telecommunication, and creative arts ventures are transforming a sleepy Faroe Islands economy into one of the more vibrant business and employment spheres available in the developed world.

If global warming progresses more swiftly than anticipated, the Faroe Islands could in a few years be dramatically altered. Sea level rise might put their fishing communities at risk, and Greenland's melting ice sheets, adding abundant fresh water to the salty Gulf Stream's flow, could reduce or halt that sea river's warming influence, ironically threatening the islanders with more severe winters.

There are lots of small insects with this same general common name and none more specific, so our featured planthopper (Acanalonia conica) will have to remain only so vaguely designated. Members of a fair number of families are all referred to as simply "planthoppers" due to their small size, inconspicuous nature, and superficial similarities. This particular kind is in the family Acanaloniidae and is among the vast majority of insects that are considered neither beneficial nor destructive from a human perspective. They are rarely noticed since they don't cause significant damage to garden crops or ornamental plantings and are simply part of the vast food web and ecological fabric that creates a healthy and diverse biome. As with all planthoppers, these tiny leaf mimics feed on plant juices, using their tube-shaped mouthparts. This pair happened to be feasting on giant ragweed. When threatened, their first defense is to remain still and rely on their leaf-like camouflage. The prying camera lens caused them to slowly change positions and try to scoot around to the far side of the stem. Their last resort is to leap off and fly away.

Is now a good time to buy stocks? That depends. Warren Buffett, CEO of Berkshire Hathaway (BRK/A and BRK/B), probably the most famous, successful, and rich value investor in the world, says the best way of assessing whether the stock market in general is fairly valued, undervalued, or overvalued is by looking at the total U.S. equity market-cap (the combined value of all U.S. stocks, based on today's prices for all shares) divided by the gross federal product. The latter refers to the total value of goods produced and services provided by a country during one year, equal to the gross domestic product plus the net income from foreign investments. When this ratio is high, meaning stock prices are on the whole significantly above the value of goods and services plus foreign investment income, the market is overvalued. If within about 10% above or below, they are likely more or less fairly valued. On the other hand, if the ratio is 0.80 or below, Buffett considers the market undervalued and says this usually is the best circumstance in which to invest in equities (stocks). An approximation of the Buffett value ratio can be obtained by dividing the U.S. market-cap (Wilshire 5000 Full-Cap Price Index) by the gross domestic product (same as the gross federal product except with foreign income excluded).

Per the website advisorperspectives.com, at the beginning of this month the ratio result (129.8) was almost at its highest point in history, second only to its level (136.5) at the end of the dotcom bubble, just prior to big market drops in 2000 and 2002, and substantially higher even than just prior to the 2008 financial meltdown (104.9), which also, of course, saw large stock market losses.

Per the website gurufocus.com, which is updated daily, the U.S. stock market is significantly overvalued and, as of 8/19/17, the ratio stood at 130.8. This site also uses the ratio to forecast estimated total returns. It predicts that investments made today will, even including dividends, over the next few years provide the average investor with a lot more losses than gains.

Based on Buffett's preferred way of assessing these things, this is probably not a good time to be doing new investing. Indeed, investors might be better off gradually selling existing holdings to raise cash, against the possibility of buying more shares once the market takes a big hit, as overall it tends to do around every 4 years or so.

| Company | Ticker Symbol | Recent Price | Featured Value Statistics |

|---|---|---|---|

| AbbVie, Inc. | ABBV | $69.96 | Forward P/E 10.80; PEG Ratio 0.91; Dividend 3.66%. |

| Alliance Bernstein Holding, L.P.* | AB | $23.10 | Trailing P/E 10.79; Forward P/E 10.36; Dividend 8.94%; Price to Book Value 1.47. |

| Amgen, Inc. | AMGN | $167.29 | Dividend 2.74%; Price to Free Cash Flow 16.85. |

| ARRIS International, plc | ARRS | $26.66 | Forward P/E 9.01; PEG Ratio 0.55; Price to Book Value 0.75; Price to Free Cash Flow 6.12. |

| Iconix Brand Group, Inc. | ICON | $5.00 | Forward P/E 7.58; PEG Ratio 0.51; Price to Book Value 0.76; Price to Sales Ratio 0.81. |

| ManpowerGroup, Inc. | MAN | $106.66 | Price to Sales Ratio 0.36; Price to Free Cash Flow 18.97. |

| McKesson Corp. | MCK | $146.00 | Trailing P/E 6.42; Price to Sales 0.15; Price to Free Cash Flow 9.62. |

| Rocky Brands, Inc. | RCKY | $13.85 | Dividend 3.17%; Price to Book Value 0.76; Price to Sales 0.39. |

| Steelcase, Inc. | SCS | $12.95 | Forward P/E 11.36; Dividend 3.91%; Price to Sales Ratio 0.50. |

| Synaptics, Inc. | SYNA | $40.36 | Forward P/E 7.85; PEG Ratio 0.70; Price to Sales 0.81; Price to Free Cash Flow 11.22. |

*Please note that AB is a limited partnership and as such for most invesotors better suited for a tax-deferred account.

Nonetheless, and here is why the answer may be "it depends," there might be reasons not to sell and even to invest further now. Investors who try to time the market get it wrong more often than not. A possible explanation is that two decisions are required for successful market timing, both when to get in and out, yet on average they do not get even one right. The way it usually works is investors wait till the market is already up a lot before believing it is safe to buy stocks, but then they get scared after the market has been down for awhile and so sell at that point, thus completing an investing "round trip" cycle in the worst manner, buying high and selling low.

To counter this, a dollar-cost-average approach is suggested, putting roughly equal amounts of funds into the market at regular intervals, such as every month or year. This has the effect of assuring they buy more shares when the market is down, fewer when it is up, resulting in a lower average cost basis. In such a scenario, to be consistent one would keep buying at intervals (even now, for instance) regardless of what the Buffett value ratio indicates about current equity valuation.

There is also the choice to acquire shares of only high value to price stocks. This can be done no matter how overbought stocks in general become. In my view, during a high-priced market like today's there are few good low price to book value candidates to be found. Nonetheless, there are still some securities with reasonable or even bargain prices in relation to other measures of value, such as free cash flow, price to sales, price to earnings, dividend yield for the price, and price to long-term growth potential. At least a handful of excellent candidates might be found among stocks sharing one or more of these measures.

Benjamin Graham pointed out in The Intelligent Investor that we can almost never tell for sure when the market will crash vs. continuing to go up into more and more nosebleed levels of height in relation to underlying value. In the 1990s, even for a few years after Federal Reserve Chairman Alan Greenspan pointed out that the market was exhibiting "irrational exuberance," share prices were surging. An investor who got out of the market in, say, 1995, because the market appeared to him or her to be fairly valued or overvalued, might have had to wait till 2000 or later to see genuinely undervalued levels again. So Graham suggested we would do well to always be invested to a degree in stocks, though we might reduce them to as little as 25% of overall liquid assets.

Whether or not we like a Graham allocation model, it may be useful, even in overvalued market times, to acquire shares of stocks available at fire sale prices.

At the table above are a few that look enticing now. If the market falls a lot from here, to me they would also be fine assets in which to invest more later on. Having a set of such value stocks can be a first step in an investor's research. How he or she winnows the field down to just the few most desirable ones is an individual thing and part of the fun. Meanwhile, considering the currently lofty level of the Buffett value ratio, it might be wise to keep a large amount of one's funds in reserve.

| |||||||||

|

While the Great American Solar Eclipse of 2017 is occurring on our publishing date (Aug. 21), we decided that it was too long a drive (about 800 miles) to reach the path of totality, where the spectacle would last about 2 minutes and 40 seconds. Instead, we are setting our sights on the NEXT total solar eclipse in the U.S., which will happen in seven years, on April 8, 2024. That path will be much closer to home; if weather conditions are good, the totality over Kerrville and surrounding areas will be about 4 minutes. It's on our calendar!

|

| For others who may have chanced upon this site, larvalbug bytes is a monthly family-and-investment newsletter, put out by an old codger and sweet thing, with sometimes a little help as well from our engaging pooch, Peri. We invite readers' comments by and would also be happy to readers when new issues are published. Articles and stories from back issues are available in our archives. |

|

Copyright © 2017 by LARVALBUG

"Selenops Eclipse" and larvalbug web design by Valerie.

![]()