|

Volume 20, Issue 2 | February 21, 2018 |

|

In this Issue:

|

|

Volume 20, Issue 2 | February 21, 2018 |

|

In this Issue:

|

The busty young woman who stood next to him by the mail sorting bins asked what had happened, where he had gone. "I attempted suicide," he said. "Well," she criticized, "you must not have tried very hard. You're not good at that either, are you?" Anti-psychotic drugs were still in his system. He felt exhausted, mentally blank, with a wad of cotton in his mouth. He focused on putting the letters in their correct street and block boxes, the work endless. Eventually he was walking home.

When he had thought he was dying or dead, there was a blur of poignant images, ordinary reality blasted away as in a tornado. The inner world was nothing but unrelieved pictures coming fast enough for an intense grasp of each, then replaced by another, equally devastating or dear: landscapes of words, then dead children, horizons of war machines, nuclear explosions decimating an entire city, then another, yet another...also perfect little birds chirping on  exquisitely detailed narrow branches with new leaves just coming out, the sun as yet not fully up, shimmering lakes, huge storms, fish leaping out of the water, a tiny skiff, its lone occupant rowing out to sea as night fell, an intricate array of forms pulsing together in a cell, a multitude of unique snowflakes, a delicious looking pile of fresh hot pancakes oozing with melted butter and pure maple syrup, the boy hungry and just digging in...

exquisitely detailed narrow branches with new leaves just coming out, the sun as yet not fully up, shimmering lakes, huge storms, fish leaping out of the water, a tiny skiff, its lone occupant rowing out to sea as night fell, an intricate array of forms pulsing together in a cell, a multitude of unique snowflakes, a delicious looking pile of fresh hot pancakes oozing with melted butter and pure maple syrup, the boy hungry and just digging in...

His kaleidoscopic introspection seemed to last months. It was less, hours at most. He found himself for a time on a locked mental ward. He was not altogether himself. Partly to pass the time, he took paper and pencils the candy striper volunteers offered him and made pleasant countryside sketches or simple, upbeat drawings of himself. Another, darker side must have still been lurking. He would come back to his bed later and find under the pillow his panoramic pictures had been altered into scenes of horror. His face and head figures were transformed into skulls. It was disturbing to have an independent, unconscious side, odd to realize this malevolent identity was the superior artist.

On his way to his digs after that first day back at work, he contemplated the room. It was actually a brightly lit, spacious place, with banks of windows opening onto a large, well tended and full of life garden. Yet to him it was a lonely space, all the more so for the mess he had made of things by nearly killing himself. He knew nobody in that house, had no car, no telephone. Now he had but a tenuous hold on employment too. Maybe he ought to simply finish what he had started.

Arriving home, he checked his mailbox. There were two or three pieces of advertising that he quickly threw away. There also was a small red envelope addressed to him. He opened it and discovered a Valentine. Inside was the typical printed message, but in neat cursive were the words: "I think you're wonderful. Would you be my Valentine?" It was signed: "A Mystery Friend." There was no return info.

The vivid, happy images from that near-death experience seemed more real now than the violence, anger, and war of his other head tripping. He had no idea who had sent him the card. He had not thought more than a dozen people knew of his existence, did not believe any would have felt that way about him. Yet when he went out to get supper he had a smile on his face. His step was lighter. If something so nice and unexpected could still occur, what else might happen? Maybe he would go on after all. Yes, he pondered, "I'll get a better job, go back to school, perhaps find out who wants to be my Valentine, maybe even fall in love."

[NPR has encouraged radio listeners to write short fiction that, if read aloud, would be 3-5 minutes in length. This turns out to be a piece of about 500-1000 words. The above, ready on 2/14/2018, was my first such effort.]

The human childhood is a prolonged stage compared to other animal species. No creature takes as long as we do to reach puberty, and, putting basic biological mileposts aside, we certainly extend our period of playful behaviors well beyond that exhibited by any other mammal, even our closest ape relatives. In fact, we never come to the end of our playful phase because we have all manner of activities in that mode that are acceptable at all ages. The standard definition of play generally encompasses actions that are performed for enjoyment and recreation, without regard to how practical, useful or important they are to an organism's continued existence.

It's easy to see how play evolved; youngsters of many animals spend time learning the skills they need to eventually reproduce, in ways that are not as dangerous or serious as what will be encountered later in life. After all, if the stakes were as high for babies as adults, almost all individuals would perish long before reaching maturity; complex life on our planet would never have made it to this point.

As the masters of environmental manipulation, we humans have afforded our young not just the opportunity to play, but we provide all kinds of specialized areas for such. Standard examples include indoor nurseries and playrooms, plus outdoor playgrounds and amusement parks. As soon as we move from the sheltered inner sanctums to the wider world outside, the anxiety level of parents goes up accordingly. It's easy to keep sharp, hot, or poisonous objects out of a room in one's house, but to remove those dangers from the external surroundings is nearly impossible. We can put a fence around some equipment that has been specially designed to be relatively safe for small bodies, but, as just about everyone knows, accidents still happen. Who hasn't been hit in the head with a still moving swing, scraped a knee at the bottom of a slide, or lost their grip on a jungle gym? When such hazards exist in thoughtfully engineered areas, what can be expected in the landscape at large?

The answer to that hypothetical question is simple: anything at all. One of the facts of life is that each person must learn to avoid things that will harm them, either by instinctive reaction, common sense, or trial and error. Somehow, with all the complexities of our world, most kids do okay. We have big brains that are primed to learn from the moment we draw our first breath. Sometimes children can even follow instructions, such as obeying after being told not to run into the street. A leash that exerts physical control is often necessary for dogs, but verbal commands should be adequate for an animal that's a little smarter. In only a couple of years, kids go from needing constant management to being savvy enough to explore their environs more independently.

That certainly seemed to be the case in my youth. I grew up in Illinois, where I was often allowed to play unsupervised in all sorts of locations. When I was a toddler, our backyard was sufficient space, and well within my mother's earshot in case I started screaming for help. An inflatable wading pool, a small trampoline with a bar to hold while jumping, some boards on concrete blocks and a diminutive swing set provided variety in an area that was conveniently surrounded by a fence (doing double duty containing both me and our dogs). I learned very early that the metal frame supporting a swing falls over if one tries to gain too much altitude with each oscillation. The same thing happens in rocking chairs, knowledge of which was gained in a wicker rocker on my grandparents' porch. I still hate wicker furniture.

Val on trampoline, 1962, Joliet, IL |

That same playground included other attractive equipment. One of my favorites was a set of small rocking horses on large vertical springs. There were three of them, each a different color. I preferred the black horse.

Along with a seesaw, metal slide, monkey bars and merry-go-round, there was one structure we never quite figured out. It was a huge metal triangle, super shiny and slippery, with an odd narrow sort of monkey bar "ladder" on the long upper side. The angle of the flat surface was such that it was more vertical than horizontal. It seemed to be a slide of some type, but there was no way to climb up, since the only possibility was to cling to the strange little bars that offered only an uncertain grip, which, if lost, resulted in a very fast descent to the unforgiving blacktop surface below. I never saw anybody actually use that thing.

While intentionally designed playgrounds were certainly attractive, we enjoyed other areas at least as much. One of the simplest was a grassy field. By summer, vacant lots in our neighborhood had grass that towered over our heads. My sister and I could make extensive tunnels through the vegetation, complete with a warren of rooms. Playing house was more like creating a maze.

During the winter, snow provided a lot of amusement, whether used for building snowmen and snow houses, or for the opportunity to slide down hills on sleds, pizza pans, skis or pieces of cardboard. Then there was ice skating. Once old enough to have mastered balancing on those thin blades, the exploration, chasing, hide and seek, hockey, and follow-the-leader games on ice became favorite cold weather pastimes.

There always seemed to be plenty of outdoor play spaces in our neighborhoods. When we lived in a rural subdivision, there were both vacant areas between yards and a creek. The roads were often devoid of traffic, so we rode our bikes everywhere. Piles of lumber, tires, old appliances, and all manner of discarded junk littered certain places, and we had everything we needed to build forts, play house, or just climb around for fun. We saw the camps of hobos (now, of course, called transients) and always avoided them, mostly because of horror stories, often embellished to sound as scary as possible, told to us by our more knowledgeable elders.

After moving to an urban setting when I was nine years old, we quickly discovered other playgrounds, although we then had to contend with tighter restrictions on private property and public thoroughfares. More than once, I was startled by cars honking at me to get out of the way as I pedaled my bicycle around businesses and back alleys. Although a church parking lot near our house had a veritable labyrinth of open areas connected by sloping ramps and sidewalks, all paved with smooth blacktop and concrete and perfect for roller skates, skateboards or bicycles, we risked incurring the wrath of the nuns who seemed to have nothing better to do than to yell at us to go away.

In spite of being in the middle of town, we still had woods and fields within walking distance of our house. Many happy times were spent climbing on the forested hillsides and exploring the open drainage canals. There were occasional reports of murders and the discovery of decomposing bodies, but that didn't dampen our enthusiasm. We were just careful to avoid any strangers.

Throughout my childhood, our parents took us with them when they went mushroom hunting or fishing. As we weren't interested in those more productive endeavors, whatever place we in were became our playground. Creeks and ponds were especially fun. Making little dams, collecting animals from under rocks, and building pretend campsites kept us busy for hours.

One of the most engaging kinds of playgrounds, and still an irresistible draw even to an old person like me, is any kind of waste dump. Old furniture, tools, appliances, vehicles, household goods and even dead animals are curiously fascinating. It was great fun to examine the internal workings of televisions, radios, washing machines and power tools, and I probably learned more about circuitry, vacuum tubes, transistors and other electronic components in trash dumps than in any formal educational setting.

Play comes in many forms, but the kind that takes place outdoors is one of my favorites. I remember somebody once telling me that he didn't like going for walks in a neighborhood park because it was boring. I couldn't believe my ears! How can anyone be bored when there is so much to see, even in the most mundane landscape? Play is a state of mind, so it can be as pervasive or as limited as one desires. The outdoors can be a place fraught with hazards, the dreary space between buildings, an uncomfortable area to traverse before reaching a destination, or it can be a playground. It all depends on how you look at it.

In a serendipitously color coordinated scene in the lobby of the Minnesota Children's Museum in Minneapolis, 10-year-old Lucas messes about with an expandable plastic sphere. It was Jan., 2010, and the weather was so cold that indoor activities were the preference that day. Lucas had recently completed bone cancer treatments and was getting used to using his new prosthetic leg.

| (The Terra Tabloid is a venue for the discussion of issues pertaining to the past, present, and future of our planet and human interaction with it.) |

In the span of time since life began on planet Earth, the duration of a species calling itself Homo Sapiens represents only about 0.006%. Yet we have reshaped the rest of the biosphere in ways far out of proportion to that miniscule temporal presence. Curious, as a thought experiment, I wondered then how things might be different if for some odd reason we were not around. That came close to being a reality, more than once, in fact. For example, around 70,000 years ago, a huge Toba Volcano eruption spewed so much ash, dust, and volcanic gases into the atmosphere that much sunlight was blocked from reaching the surface for years, and climate was radically altered long enough that many plants and animals died off. Average temperatures are thought to have plummeted 20 degrees. We would have been killed off too, evidently, except that there were remnants of us left here and there, for instance in a few coastal regions, probably living off shellfish and such till normal life returned, the survivors could resume food gathering as usual, and people began again to populate the planet with what would become the ancestors of us all. Estimates are that at our lowest point in that crisis only about 1000 adult humans were alive. Some scientists think as few as 40 child-bearing women remained to continue our kind and so eventually dominate the orb with seven-plus billion of us.

How might things be different without our kind? Here are a few of the ways, according to what can easily be discovered through library and web reading:

Trees - The number of trees left in North American today is reduced by probably 95-99 percent from what would have been the case if not for the presence of people, our development, and a multitude of agricultural and ranching projects. Also, there is now almost no old growth forest remaining, whereas without us most trees would fit that category. Besides Pacific Coast giant redwoods and sequoia forests, there would be vast expanses of old growth hardwoods and softwoods, with deciduous and coniferous trees in abundance and stretching both coast to coast and from well inside what is now Canada through present day northern Mexico.

In the area we now regard as New England, for instance, there were once oaks and sycamores 10-20 feet thick and white pines 250 feet in height. Imagine virgin, old growth forest in most areas, starting from a short distance inland from the sea, their expanses mostly broken but by river valleys, deserts, grasslands, and mountains. Lightning would certainly have sparked fires in temporarily dry areas, and occasionally these would grow long and hot enough to consume old growth, from which patches of younger trees would compete with one another for the new space and light at forest floor and ground level, but for the most part the burning would just take out smaller brush or already dead or fallen wood, adding natural fertilizer to the mix.

Animals - Our hypothetical viewer of an area free from human intervention would likely be struck at once by the sheer profusion and variety of wildlife. Among mammals alone, besides millions of bison, there would have been a multitude of deer, coyotes, bats, goats, elk, pronghorns, moose, foxes, mink, badgers, wolves, porcupines, mountain lions, skunks, and peccaries. There might also still be many of the now extinct mega fauna, including ground sloths, saber tooth tigers, mastodons, giant beavers and armadillos, short-face bears, mammoths, camels (actually more closely related to llamas), horses, American cheetahs, etc. There would as well be innumerable wild birds, some of which we would recognize and others totally foreign to us, not to mention great quantities of common and exotic amphibian, reptile, and fish species. Mushrooms, spiders, insects, crustaceans, and mollusks would likely be so numerous and diverse as to keep my science-nerd spouse delightedly busy for several lifetimes.

Beaver ponds - Most untrammeled rivers and streams would be marked by a spacing of countless beaver dams, creating luxurious meadow systems through much of our North American continent. These in turn would assure perfect habitat for many creatures and for flora needing abundant light, rich soil, and water resources. Before trappers took out the majority of beavers for pelts, this was the norm in many areas throughout the region. The beaver ponds in turn would also have prevented most flooding and yet spread vital water and silt through wide areas in a stable manner, easy for life to profit from.

Topsoil - Without over grazing and farming or paving over practices or simplistic engineering projects, most areas of North America probably would have several more feet or even yards of rich topsoil. Not only does this preserve healthy root systems but it helps allow for the soaking in of rainfall and its slow provision to plants and animals between showers and seasons. By contrast, for instance, Texas hill country, known for its rocky outcroppings and flash floods, now has little average thickness of topsoil left.

Coastal areas - The conditions in early New England may illustrate how things might be with few or no people about. When Native Americans belatedly showed up on the cold shores of a state we now call Maine, they encountered huge stores of cod, many so big they could be caught by hand, plus vast quantities of herring, clams, oysters, crabs, lobsters, and millions of water fowl, their eggs plentifully available.

Grasslands - Many areas of our continent are perfect for savannas or grassland. They are naturally augmented by lightning strike fires, these consuming dead vegetable matter and at the same time fertilizing the area for the good of subsequent plant growth. Thick mats of grasses' roots and decaying matter hold often scarce moisture, prevent erosion, and offer subterranean hostels for certain animals. The streams are typically full of fish, crustaceans, and water dwelling insects or mollusks. Without the intervention of people, creatures adapted to the savannah would live in abundance in these environments, including prairie chickens, bison, prairie dogs, bobcats, bald eagles, mountain plovers, greater sage grouse, ground squirrels, prairie kingsnakes, wolves, coyotes, foxes, black-footed ferrets, badgers, gophers, and pronghorn.

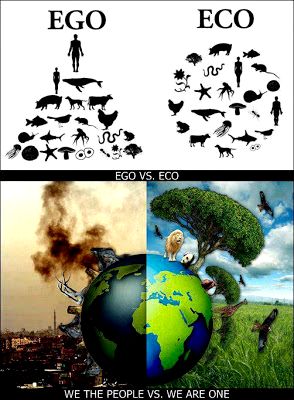

Thinking about a world without humans is only an interesting idea in itself. To me, there is a lesson in it, though: when one species comes to so dominate the biosphere that the results taken together are supremely adverse to much of the rest of the environment, nature tends to apply corrective measures if that life form does not on its own adapt in a more sustainable way. Conservation measures have a vital place in our priorities. So do finding ways to live responsibly with our floral and faunal friends. Certainly we can instead ignore the needs of the balance of the natural world and re-create the surface of Earth in a manner to make it fit only for ourselves, thus permitting, perhaps, the addition of yet a few billion more humans. Is this, though, truly the best use of our kind's supposedly superior intelligence? A little wonder at the awesome spectacle of bountiful life as yet all around us may give answer. Let us not forget the needs too of Brother Bear or Sister Honeysuckle as we plan for a better present and future for ourselves and our pearly world.

Primary sources:

-How Human Beings Almost Vanished from Earth in 70,000 BC. Robert Krulwich in www.npr.org; October 22, 2012;

-The World Without Us. Alan Weisman, Thomas Dunne Books, St. Marin's Press, New York; copyright 2007.

Most moths are nocturnal, so they need a way of avoiding predators when they are inactive during daylight hours. Lacking fangs, pincers or spines, their best defense is camouflage, and it can take some outlandish forms. The eggplant leafroller moth (Lineodes integra) has the usual disruptive brown wing and body markings that tend to allow insects a degree of invisibility against a naturally colored background. But this species goes a bit further to look as un-moth-like as possible. The exact reason that these creatures curl their abdomen up and forward, often to the point that the tip touches the front of the face, is not known. When compared to a typical moth in resting position, this certainly does not match the normal example and so may escape notice by a bird or other hunter that has a more characteristic search image in mind. Whatever the exact model for the strange pose, be it a dried leaf tip, bits of dead grass or the frayed end of a broken branch, the masquerade must work: this is a relatively common moth for much of the year.

Most everyone has heard of the real estate bubble whose bursting roughly a decade ago also precipitated vast losses of personal wherewithal for tens of millions of Americans plus an economic and equity meltdown that threatened the entire globe's financial system. That investing mania was typical of several which have occurred over the centuries. The most famous, probably, is the great Tulip Fever that gripped Europe in the early 17th Century. Before the collapse of the tulip market in 1637, a single bulb of a certain variety could cost over ten times the annual pay for a skilled Dutch craftsman or in other instances as much as twelve acres of fertile land.

Another notorious instance of market mania involved the British South Sea Company. Its history is complicated but involves a scheme to pay off a large amount of Britain's debt, government corruption, talking up in all quarters a fraudulent, fictitious level of basic company value, plus a frantic level of buying that took the price of a single share of almost worthless stock from 100 pounds to over 1000 in a single year, 1720. Eventually, as sooner or later occurs with all market manias, sellers far outnumbered buyers, and a bubble collapse ensued, the price plummeting back that same year to about 100 pounds a share. Along the way, banks which had loaned frenzied speculators money went bankrupt. As notable an intellect as Sir Isaac Newton lost a bundle in the South Sea Company mania, afterward saying he "could calculate the motions of the heavenly bodies but not the madness of the people."

Prior to the Great Depression, so calamitous an event as to inspire some regulatory controls on stock trading, it was common for "investors" to be able to borrow vast sums on very small amounts of actual equity. People might put up 10% in collateral and buy as much as ten times that amount in stock shares, mostly on margin. As markets are prone to go both up and down, this type practice helped lead to several devastating market crashes between the mid-1700s and 1932. Although most people alive today think of the 1929 to 1932 crashes as the worst such events in history, earlier generations had to contend with the bursting of equity bubbles in 1769, 1791, 1796, 1819, 1825, 1837, 1847, 1857, 1866, 1869, 1873, 1882, 1884, 1893, 1896, 1901, and 1907. From 1932 through 1935, however, legislation was passed that for many decades limited the amount of speculation and margin buying possible in our major stock markets.

Currently, however, new investment instruments, with huge sums put into highly leveraged derivatives, for example, are again offering speculators and financial institutions plenty of opportunity for risky ventures, some of which could again, as in 2008, threaten our monetary system.  In hindsight, many like to paint the 2008-2009 collapse in rosier terms. Realistically, it is hard to overestimate how close we all were to ruin from that relatively recent financial disaster. By both luck and skill regulators, legislators, and executives helped prevent an unprecedented loss in financial liquidity around the world. Even so, few were left untouched by that event, many losing their homes and savings. Globally, multiple trillions of dollars in former value were lost in just a little over one year of financial meltdown.

In hindsight, many like to paint the 2008-2009 collapse in rosier terms. Realistically, it is hard to overestimate how close we all were to ruin from that relatively recent financial disaster. By both luck and skill regulators, legislators, and executives helped prevent an unprecedented loss in financial liquidity around the world. Even so, few were left untouched by that event, many losing their homes and savings. Globally, multiple trillions of dollars in former value were lost in just a little over one year of financial meltdown.

This then is the background for a consideration of what makes for a mania and whether any of these phenomena are around in modern times.

Manias have several elements. As with tulip bulbs, these are not limited to stock markets:

In recent years, we have seen a few major and minor examples:

Gold - Cost $17 an ounce in 1931, but reached $1895 an ounce on 9/5/2011, though gold is not nearly that useful as an industrial commodity, rising only on speculative concerns, and since has gone down to a more modest $1357, hardly keeping up with inflation since its high. Between 9/5/11 and now, gold has often been much lower, for instance only $1109 an ounce in November, 2015, a 41% discount to the top gold fever level. One lesson of market manias would seem to be that simply waiting, instead of rushing to purchase what the madding crowd is currently into, can pay big dividends.

Cabbage Patch Kids - These dolls were fairly cheap to make and retailed for $25 in the 1980s. As they caught on, however, prices tripled and more. They were going by the end of 1983 for $150 apiece and "uncaring" parents who did not get at least one of the collection for their offspring were treated to a lot of guilt-tripping. If bought in new condition today, they can be obtained for $22 to $32, off roughly 82% from their peak during the Cabbage Patch craze.

VXX - As the stock market began to recover from the 2008-2009 financial debacle, a new hedge developed against the possibility that what goes up must come down, a volatility index. This derivative, VXX being the stock ticker for Barclays plc iPath S&P 500 VIX ST Futures ETN, is supposed to go up when volatility increases in the equities markets, down when they are calmer. The idea is that as markets become more volatile, there is more risk they will not just go a lot higher but also may plummet. So VXX is theoretically seen as a way of protecting against the tendency sooner or later for markets to fall big time. The trouble is that it is most effective only on a short-term basis. Its value tends to go down a lot over time, so it is best bought when one is fairly sure markets are about to crash. Unfortunately, few are great market timers, so for all but the luckiest among us investing in VXX as a long-term proposition is a losing game. Those who were unhappy enough to buy when VXX was at the height of its bubble, in 2009 and held on to their shares, have by now, after several reverse stock splits, lost over 99.96%. Even those who bought more recently, for instance in February, 2016, when it reached $457, have either gotten out at a loss or held on for a 90.0% reduction in their investments.

Pot Stocks - I had not heard of this kind of asset till last month, but believe it is catching on as a new sort of speculation. If unkind, one might be tempted to say investors have smoked some of the source of the profits. However, the purchase of such stocks, whose attraction is that they are in one way or another connected to the increasing trend among states to legalize at least medicinal uses of marijuana, is taking on a bit of a craze aspect perhaps reminiscent of investment in stills, speakeasies, and bootleg whiskey during Prohibition days, anticipating that it would before long become legal to sell and drink the hard stuff again. Now as then, federal government agencies stand instead for law and order and vow to put the full weight of their authority into shutting down and prosecuting violators. Till that changes, can companies that look to make gains on weed sales be into a reasonable business model? Despite a rationale for avoiding them as speculative, pot stocks are often doing well. I do not yet know if they represent a mania, though. Maybe Congress and a new administration will later see things differently, and if so those who got in on the ground floor and held on could look smart in years to come. A couple of the leading pot stocks are Canopy Growth Corp. (TWMJF) and G W Pharmaceuticals (GWPH). TWMJF has been as high as $29.95 or as low as $19.40 in January of this year alone, a 35% drop from its single-month high. GWPH was selling for $38.46 on 3/7/2016 but went for $138.55 on 1/22/2018, a 260% increase in less than two years. Neither company is close to making a profit.

Crypto currencies - Those who have not drunk the Cool-Aid may not agree, but many are now hot to try this promising phenomenon. It may have seemed foolish at first, for, after all, how could one spend his or her gains and where would the purchased assets be put if only online? Nonetheless, for this kind of investment as well the jury might still be out concerning if it is or is not a mania. Each $22 spent on a single bit coin less than 5 years ago is now worth $10,074 (as of 2/15/2018), and at one time could even fetch $13,800 a 62,627% increase. People who got in on the ground floor are supposedly millionaires and even billionaires after putting in only modest sums. Nonetheless, investments are based on a share in profits. Is the interest in bit coins and other crypto currencies due to how much money they offer those who own them and their comparatively greater value compared with, say, the American Dollar, the British Pound, or the European Euro, or is it primarily due to merely the spiking cost of such crypto currencies and the assumption there will be, for awhile at least, enough more buyers than sellers, that the price will keep surging plus  the hope one will then get out before enough other people realize there is little basis to the rise other than hype? Advocates might answer that, just as pharmaceutical or biotech companies offer shares in their future profits, on the expectation they will make discoveries through research and development, even though at present their net income has not been realized, so too with crypto currencies whose potential might be as tremendous as the internet itself, the significance of which was greatly underestimated at first. Of course, dot-com companies also had a lot of potential, it was said, but look what happened to them at the end of their bubble. Are there ways to invest in assets with highly uncertain outcomes but a lot of volatility? Yes, certainly, but this usually requires quite a bit more in reserves, to take advantage of the dips, and, as with VXX, there is always the possibility the current dip will be one from which there is little recovery. When the music stops, not everyone will find a profitable place to rest till it might begin again. Meanwhile, new circumstances keep fouling up our plans. On the other hand, when Amazon was just getting started, it likely appeared to many but a foolish venture, and that has not turned out too badly.

the hope one will then get out before enough other people realize there is little basis to the rise other than hype? Advocates might answer that, just as pharmaceutical or biotech companies offer shares in their future profits, on the expectation they will make discoveries through research and development, even though at present their net income has not been realized, so too with crypto currencies whose potential might be as tremendous as the internet itself, the significance of which was greatly underestimated at first. Of course, dot-com companies also had a lot of potential, it was said, but look what happened to them at the end of their bubble. Are there ways to invest in assets with highly uncertain outcomes but a lot of volatility? Yes, certainly, but this usually requires quite a bit more in reserves, to take advantage of the dips, and, as with VXX, there is always the possibility the current dip will be one from which there is little recovery. When the music stops, not everyone will find a profitable place to rest till it might begin again. Meanwhile, new circumstances keep fouling up our plans. On the other hand, when Amazon was just getting started, it likely appeared to many but a foolish venture, and that has not turned out too badly.

What then can we say of the U.S. stock market? Is it in mania territory or are folks rational who have kept pouring trillions of dollars into it in recent months?

Is the current level of price to value sustainable? No. Seldom has the underlying value compared with stock prices been so low. Despite the modest correction of late, average price to earnings, price to book, price to sales, and price to free cash flow are way too high considering the underlying level of profitability of American companies.

Similarly, stocks are on average offering only about a 1.9% annual dividend. Traditionally, 40% of equities' total return comes from their yield. Calculating that out, at best the currently low dividend level suggests a total return for present day buy and hold investors of only about 4.8%, less than a 3% real return if inflation stays at around 2% a year. Further, based on the total U.S. equity market to gross domestic product ratio, stocks are at such a high level relative to productivity that they are likely to lose investors' money in the next few years.

With unemployment near historic lows, wages will be rising, a drag on profits. With added deficits from policies recently implemented, sooner or later the national debt will have to be paid via severe cuts in services and/or added taxes, a drag on consumer spending. With the population aging and not sufficiently replaced by young people or significant immigration, productivity will be declining. With a greater emphasis on tariffs and go-it-alone trade approaches in lieu of international agreements and cooperation, our economy will suffer. All will cut into companies' bottom lines, and stock prices will follow their declines down. What is more, interest rates are rising. In past such environments, stocks have usually fallen, often sharply. If, despite these considerations, investors keep piling into our stock markets, they are doing so irrationally. Their gains will almost certainly be no better than modest over the long haul.

However, bull markets seldom cease simply because they are overvalued. Almost always there is first a catalyst that bursts the bubble. What might it on this occasion and when will it occur? Who knows? It may take a few more years or could happen this week.

Meanwhile, the band keeps playing, and our stocks and 401k accounts keep going up. Even after a briefly scary correction a bit earlier this year, the S&P 500 Index is up 303% since March 9, 2009. Is it not grand?

[Coming next month: Which Assets Are Being Ignored - Definitely NOT in Mania Mode?]

| |||||||||

|

The word from that weather guru, the Woodchuck (aka Groundhog), who lives up north and makes predictions on Feb. 2, was that winter would last 6 more weeks. Of course, this is just a fun folk tradition, since a rodent seeing its shadow doesn't mean diddly-squat about anything except that it was sunny that day. In one sense, winter always lasts precisely as long as it takes to get to the Vernal Equinox. It is also rather difficult to determine just what, exactly, constitutes "winter," especially here in central Texas, where we are currently enjoying the time of temperatures being less than 100°F.

|

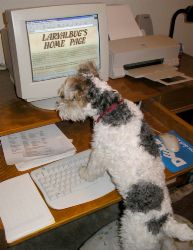

| For others who may have chanced upon this site, larvalbug bytes is a monthly family-and-investment newsletter, put out by an old codger and sweet thing, with sometimes a little help as well from our engaging pooch, Peri. We invite readers' comments by and would also be happy to readers when new issues are published. Articles and stories from back issues are available in our archives. |

|

Copyright © 2018 by LARVALBUG

"Clockwork Bug" and larvalbug web design by Valerie.